Chinese Gold Demand Improved in August | SchiffGold

Chinese gold demand improved on multiple fronts in August.

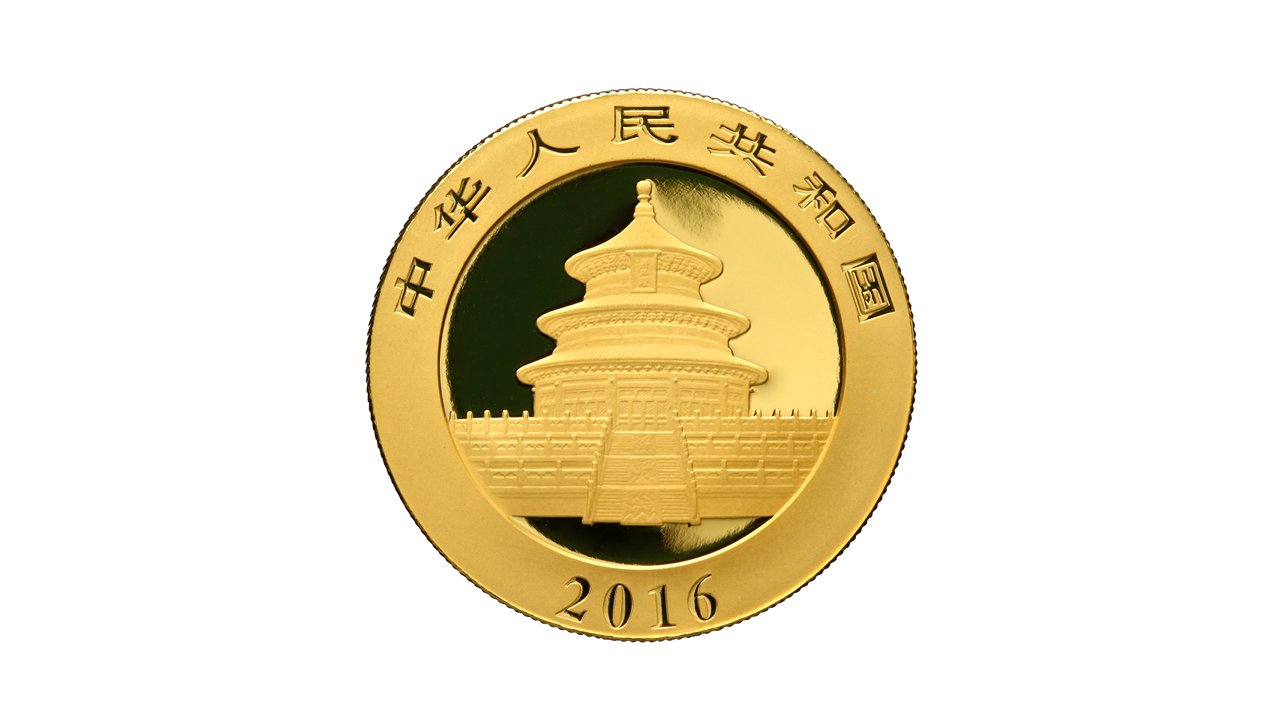

China ranks as the world’s biggest gold market.

While the price of gold declined in dollar terms last month, it was up 1.8% in yuan due to Chinese currency weakness.

With prices rising, gold has outperformed most other assets in China, according to data from the World Gold Council.

Gold withdrawals from the Shanghai Gold Exchange (SGE) totaled 161 tons last month, reflecting strong wholesale demand for gold. This represented a 46-ton month-on-month increase.

Year-on-year, withdrawals from the SGE were down a modest 5 tons. According to the World Gold Council, this was “mainly due to 2022’s distorted seasonality amid COVID-related restrictions and a lower local gold price.”

Chinese Valentine’s Day and various jewelry fairs are scheduled in September. This will likely boost retail demand this month.

Also reflecting strong domestic gold demand, the Shanghai-London gold price spread averaged $40/oz in August, a new record high. This was a $23 per ounce month-on-month increase. According to the WGC, “We believe improving gold demand and relatively tepid imports in recent months may have led to local demand and supply conditions tightening, pushing up the local gold price premium.”

Chinese gold import data lags by one month, so the July data is the most recent. China imported 107 tons of gold in July, 9 tons higher than June’s total. Compared to last year, imports were down 69 tons.

Chinese investors appear to be turning to gold. Metal flowed into Chinese gold-backed ETFs for the third straight month in August. Funds based in the country added 4.6 tons of metal, raising the total AUM to $3.6 billion.

During the month, poor equity market performance (CSI300: -6%) and continued local currency weakness drove many to safe-haven assets such as gold, which has delivered attractive returns so far in 2023.”

Meanwhile, the People’s Bank of China added more gold to its reserves in August. It was the 10th straight month of gold buying for the Chinese central bank with an addition of 29 tons. The PBoC now officially holds 2,165 tons of gold. You can read more about central bank gold buying HERE.

Looking ahead, the World Gold Council said an improved outlook for China’s economy could provide some support for local gold demand.

Also, various jewelry fairs and industry events may spur both manufacturers’ and retailers’ replenishing demand. Furthermore, with the National Day Holiday and Mid-Autumn Festival approaching, retailers’ inventory restocking is likely to continue.”

However, high gold prices could create some headwinds for the Chinese gold market.

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!