Post-halving 2024 market is pushing Bitcoin’s price, not just Trump, says Onramp Bitcoin co-founder – CoinJournal

- The last Bitcoin halving took place in April when the block reward dropped from 6.25 Bitcoin to 3.125 Bitcoin

- Jesse Myers said Bitcoin’s price needs to go higher for a “supply-demand price” balance to happen

- When that occurs, the market will “flywheel into mania and a bubble,” which happened in the 2012, 2016, and 2020 Bitcoin halving events

Donald Trump’s re-election into the White House isn’t “the main story” for Bitcoin’s recent price rally, says Onramp Bitcoin’s co-founder.

In a post on X, Jesse Myers said the main reason is that the market is at the “6+ months post-halving” mark.

Taking place every four years, the last Bitcoin halving occurred in April when the block reward dropped from 6.25 Bitcoin to 3.125. As a result, each new block becomes harder to solve with a lower reward.

A reduction in Bitcoin supply typically means an increase in the price of Bitcoin. The next Bitcoin halving is expected to occur sometime in 2028.

According to Myers, a “supply shock has accumulated,” meaning “there’s not enough supply available at current prices to satisfy demand,” adding that a “supply-demand price equilibrium must be restored.”

However, the only way Myers believes this will happen “is for the price to go higher, which will flywheel into mania and a bubble, but that’s how this thing works.”

Post-halving bubbles

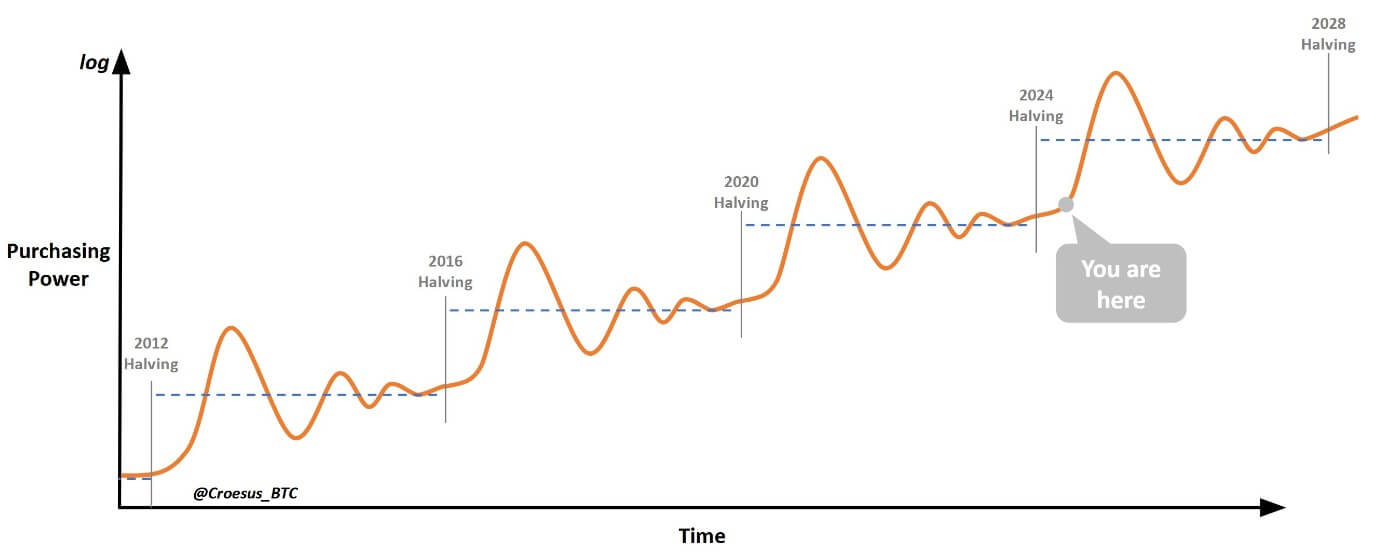

Supplying a chart, Myers indicated that the market is currently at the start of the post-halving bubble. Based on his data, Bitcoin’s price will continue its upward trajectory before peaking to new highs and dropping to current levels.

“It sounds crazy to say there will be a reliable, predictable bubble every 4 years,” said Myers. “But then, there’s never been an asset in the world where new supply creation is halved every 4 years.”

Post-halving bubbles happened in the 2012, 2016, and 2020 Bitcoin halvings, said Myers.

The recent Bitcoin price rally comes amid Trump’s re-election into the White House. Based on his campaign trail in the lead-up to election day, Trump came across as pro-crypto compared to current Vice President Kamala Harris.

Last week, Senator Cynthia Lummis also reaffirmed plans that the US is going to build a strategic Bitcoin reserve. If passed, the senator’s Bitcoin Act would propose directing the US Treasury to buy one million over the next five years.